WREN Insurance Network

Call us: 803-762-8989

Put our expertise to work for you. At WREN Insurance Network, we constantly seek the latest, non-prejudicial information that can effect your financial future and quickly distribute it to our valued clients so they can make educated and well informed decisions.

4% RULE NO LONGER SAFE?!

A new study that suggests that the 4% withdrawal rate may not be the safest bet for your retirement income. By debunking the traditional investment-based retirement philosophy, this study has been a huge aid in educating clients and only strengthens the case for vehicles that provide guaranteed income such as fixed annuities.

Request Your Free Download of this compelling article, by filling out the form above!

News and Reviews for WREN Investment Network

RETHINKING WHAT'S AHEAD IN RETIREMENT

Americans face an era of transformation with a new emphasis on guaranteed income as they prepare for retirement.

INTRODUCTION – the new reality:

The world of retirement planning is on the precipice of a new reality. The era of retirees being rewarded with a gold watch and lifetime pension after 35 years of work with a company has virtually disappeared. A combination of unpredictable markets, the erosion of defined benefit plans, the uncertainty about Social Security, and longer life expectancies means a new paradigm is emerging in retirement planning, challenging long-held beliefs in financial planning. This shift creates an opportunity to help Americans redefine how they plan for retirement and generate guaranteed income for life, a benefit unique to annuities.

Request Your Free Download of this compelling article, by filling out the form above!

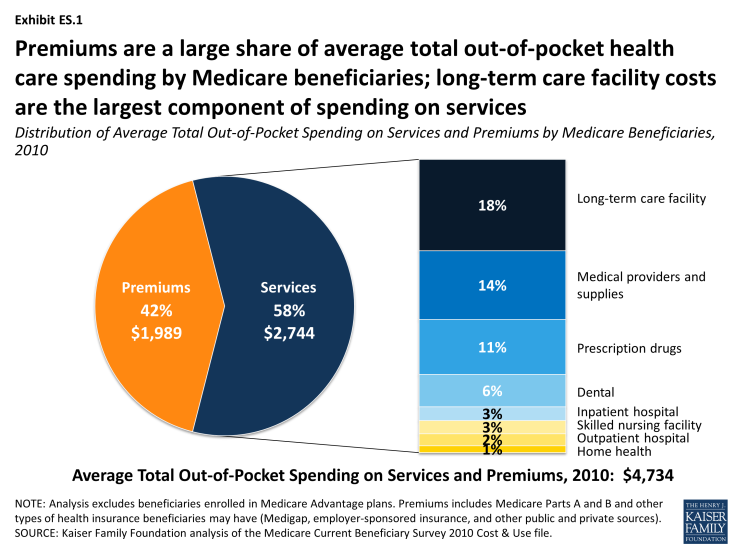

KAISER Report: Variations and Trends in Medicare Beneficiary's Out-of-Pocket Spending

SUMMARY: As part of efforts to rein in the federal budget and constrain the growth in Medicare spending, some policy leaders and experts have proposed to increase Medicare premiums and cost-sharing obligations. Today, 54 million people ages 65 and over and younger adults with permanent disabilities rely on Medicare to help cover their health care costs. With half of all people on Medicare having incomes of less than $23,500 in 2013, and because the need for health care increases with age, the cost of health care for the Medicare population is an important issue.1

Although Medicare helps to pay for many important health care services, including hospitalizations, physician services, and prescription drugs, people on Medicare generally pay monthly premiums for physician services (Part B) and prescription drug coverage (Part D). Medicare has relatively high cost-sharing requirements for covered benefits and, unlike typical large employer plans, traditional Medicare does not limit beneficiaries’ annual out-of-pocket spending. Moreover, Medicare does not cover some services and supplies that are often needed by the elderly and younger beneficiaries with disabilities—most notably, custodial long-term care services and supports, either at home or in an institution; routine dental care and dentures; routine vision care or eyeglasses; or hearing exams and hearing aids.

Many people who are covered under traditional Medicare obtain some type of private supplemental insurance (such as Medigap or employer-sponsored retiree coverage) to help cover their cost-sharing requirements. Premiums for these policies can be costly, however, and even with supplemental insurance, beneficiaries can face out-of-pocket expenses in the form of copayments for services including physician visits and prescription drugs as well as costs for services not covered by Medicare. Although Medicaid supplements Medicare for many low-income beneficiaries, not all beneficiaries with low incomes qualify for this additional support because they do not meet the asset test.

Because people on Medicare can face out-of-pocket costs on three fronts—cost sharing for Medicare-covered benefits, costs for non-covered services, and premiums for Medicare and supplemental coverage—it is important to take into account all of these amounts in assessing the total out-of-pocket spending burden among Medicare beneficiaries. Our prior research documented that many beneficiaries bear a considerable burden for health care spending, even with Medicare and supplemental insurance, and that health care spending is higher among older households compared to younger households.2

This new analysis builds on prior work to examine out-of-pocket spending among Medicare beneficiaries, including spending on health and long-term care services and insurance premiums, using the most current year of data available (2010) from a nationally representative survey of people on Medicare. It explores which types of services account for a relatively large share of out-of-pocket spending, which groups of beneficiaries are especially hard hit by high out-of-pocket costs for services and premiums, and trends in out-of-pocket spending on services and premiums between 2000 and 2010.

Request Your Free Download of this compelling article, by filling out the form above!